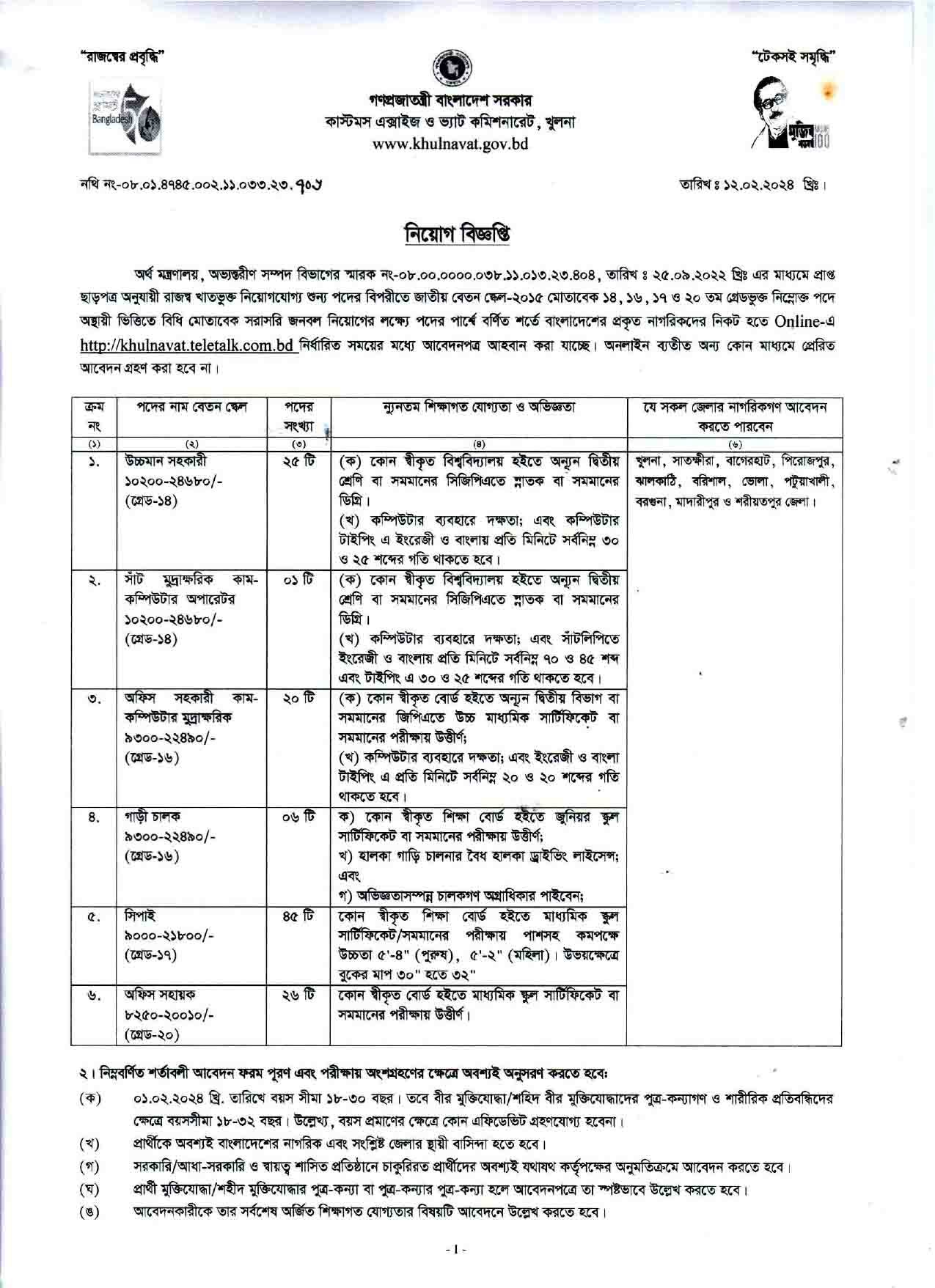

Customs Excise & Vat department, Khulna recently 123 people in various posts Recruitment will be provided. Published job circular for the said posts. This is an excellent opportunity for job aspirants who are interested in working in the government sector. Submit the eligibility and fill the form online through their given website. Check out the available post notification with important information regarding the application process.

Briefly see how many posts number and how many people in which grade

- Upper Division Assistant (Grade-14): 25 positions

- Steno-Typist cum-Computer Operator (Grade-14): 1 position

- Office Assistant cum-Computer Typist (Grade-16): 20 positions

- Driver (Grade-16): 6 positions

- Sepoy (Grade-17): 45 positions

- Office Sohayok (Grade-20): 26 positions

| Type oF jobs | Govt Job |

| Total Post: | 123 Parson |

| Application Start Date: | 15th February 2024 |

| Application End Date: | 06th March 2024 |

| Official Website: | https://www.khulnavat.gov.bd |

| Our Website: | BDJOBS21.com |

Customs Excise & Vat job Details 2024

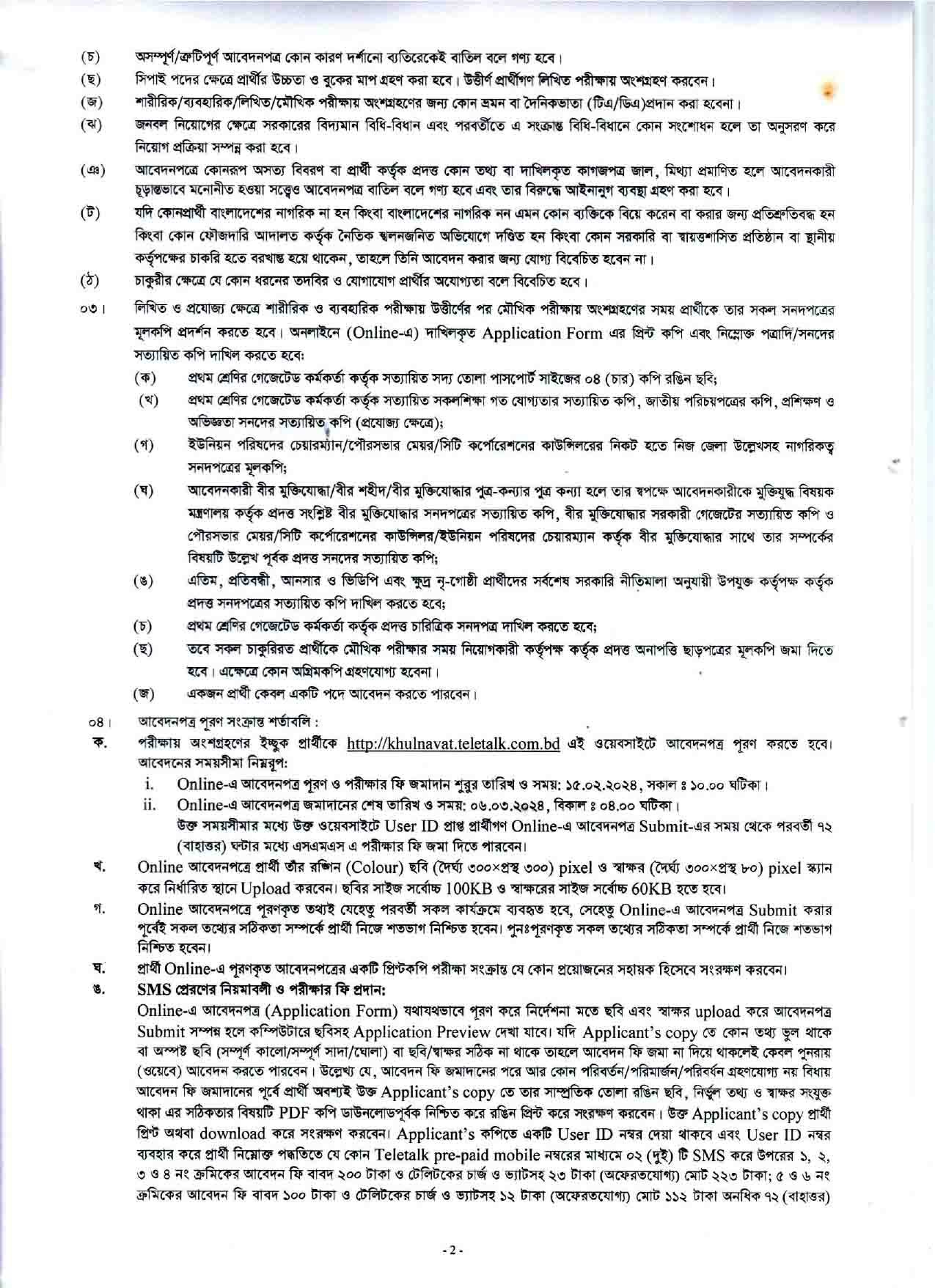

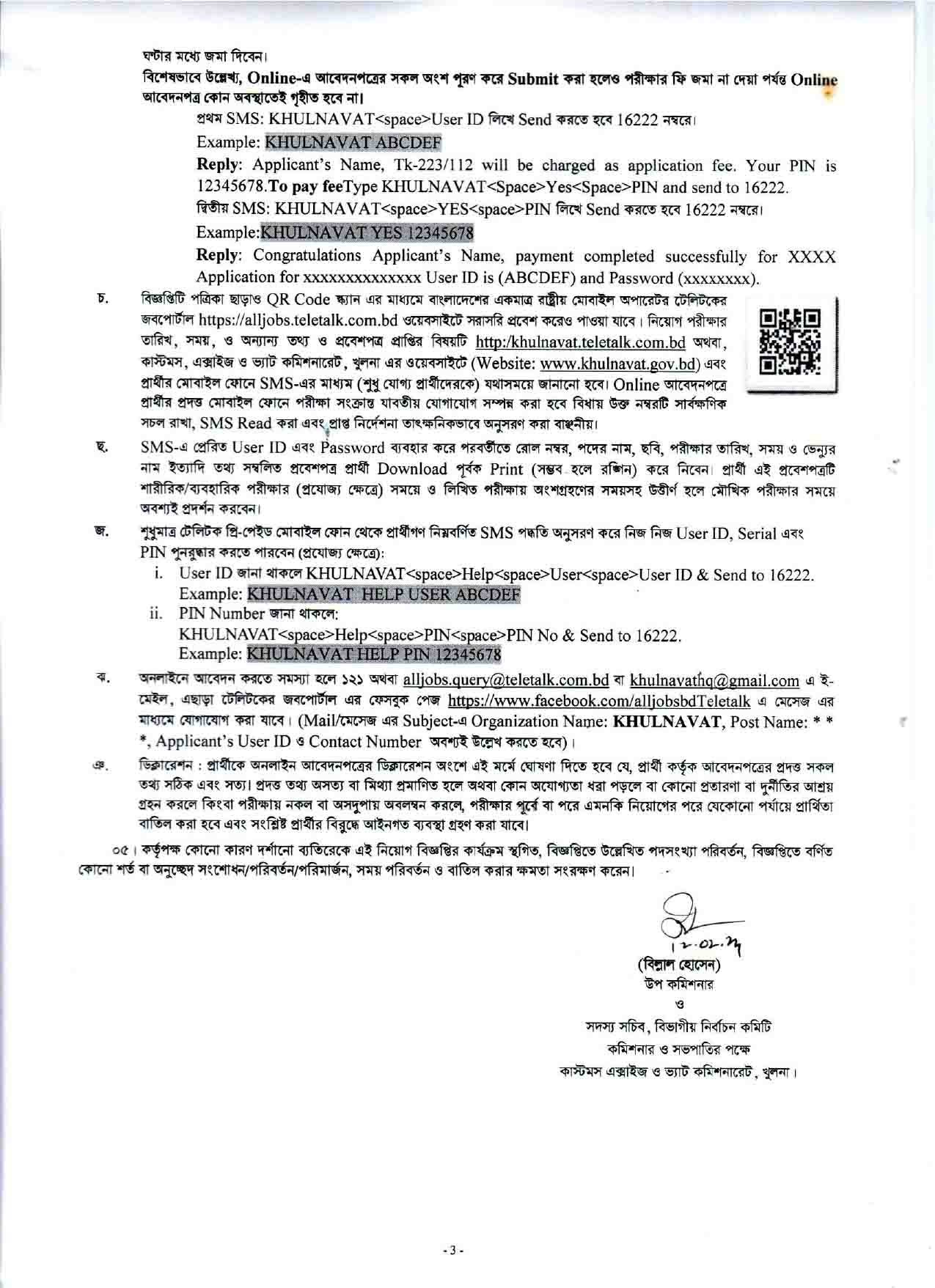

Interested candidates can apply for the posts within the specified time. Application Process Follow the following steps. Check out the application guidelines in detail. Submission of application form and type of recruitment, rules of payment, which post to apply according to educational qualification are all given in the recruitment circular below. Take a look:

Role of Caste Excise and VAT Commissioner ate

Customs plays an important role in controlling the movement of goods in and out of the country. Among their main responsibilities are notable tasks such as:

Collection of import and export duties and accurate determination of values.

Enforcing trade regulations and restrictions. Exclusion of harmful products.

Prevent entry of prohibited or restricted goods

Ensuring compliance with trade agreements

Conduct product inspection and testing plays a role.

For businesses engaged in international trade

compliance with customs and VAT regulations is essential for complying with these regulations of customs and tax governments. There are some key steps to ensure compliance:

- Understand the regulations

It is very important to have a clear understanding of the customs and regulations of Assisting the country in which you are doing business Familiarize yourself with the specific requirements, documentation, and procedures required for import and export. Assisting in this task is the main goal - Categorizing Institutional, Proprietary Consumer Products

It is essential to classify the products of the organization correctly to determine the correct duty and duty. Convert to a different category. Each product has a specific Harmonized System (HS) code that identifies its category and helps determine applicable duties and taxes. They perform this important duty.

Conclusion

Ensures proper control measures. By understanding and complying with these regulations, businesses can successfully navigate the complexities of international trade. Be sure to stay informed, maintain accurate records, and seek professional guidance when necessary. Compliance with customs and VAT department regulations not only ensures smooth operations but also promotes trust and credibility in the global market. Therefore, this work carries out extensive development work in the work of the government and the people.

Conclusion

Ensures proper control measures. By understanding and complying with these regulations, businesses can successfully navigate the complexities of international trade. Be sure to stay informed, maintain accurate records, and seek professional guidance when necessary. Compliance with customs and VAT department regulations not only ensures smooth operations but also promotes trust and credibility in the global market. Therefore, this work carries out extensive development work in the work of the government and the people.

Conclusion

Ensures proper control measures. By understanding and complying with these regulations, businesses can successfully navigate the complexities of international trade. Be sure to stay informed, maintain accurate records, and seek professional guidance when necessary. Compliance with customs and VAT department regulations not only ensures smooth operations but also promotes trust and credibility in the global market. Therefore, this work carries out extensive development work in the work of the government and the people.